La Plata County Real Estate Market, 3rd Quarter Statistics:

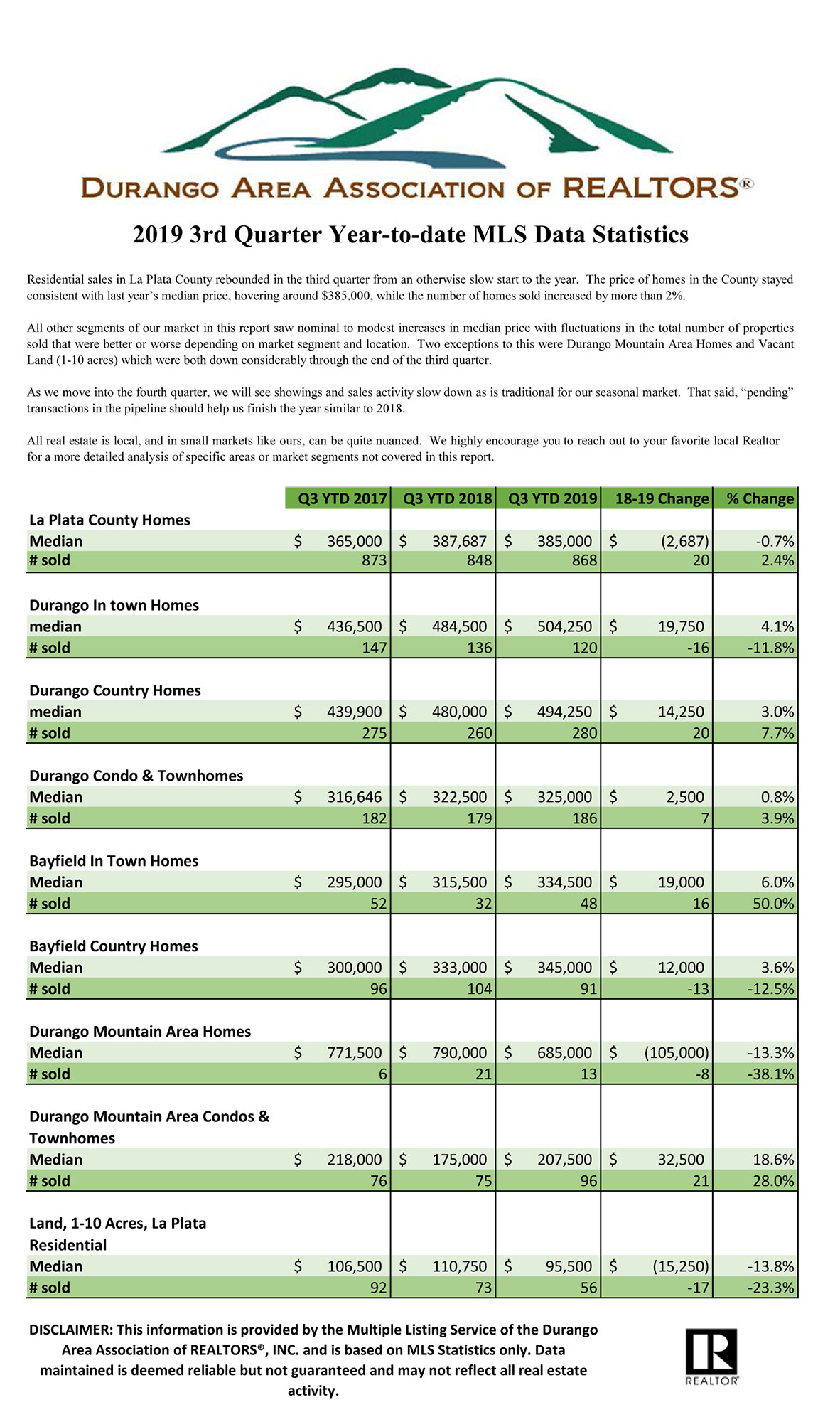

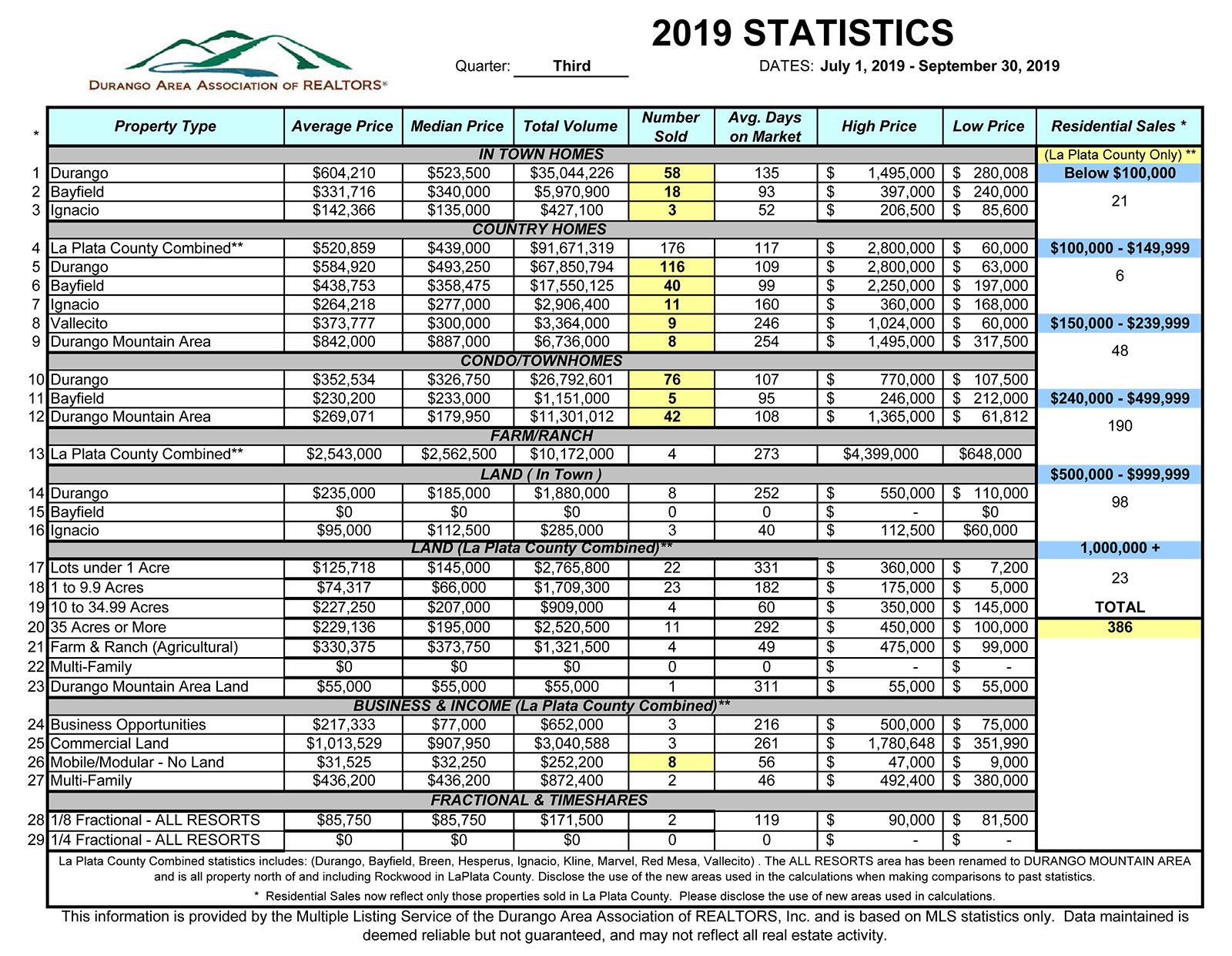

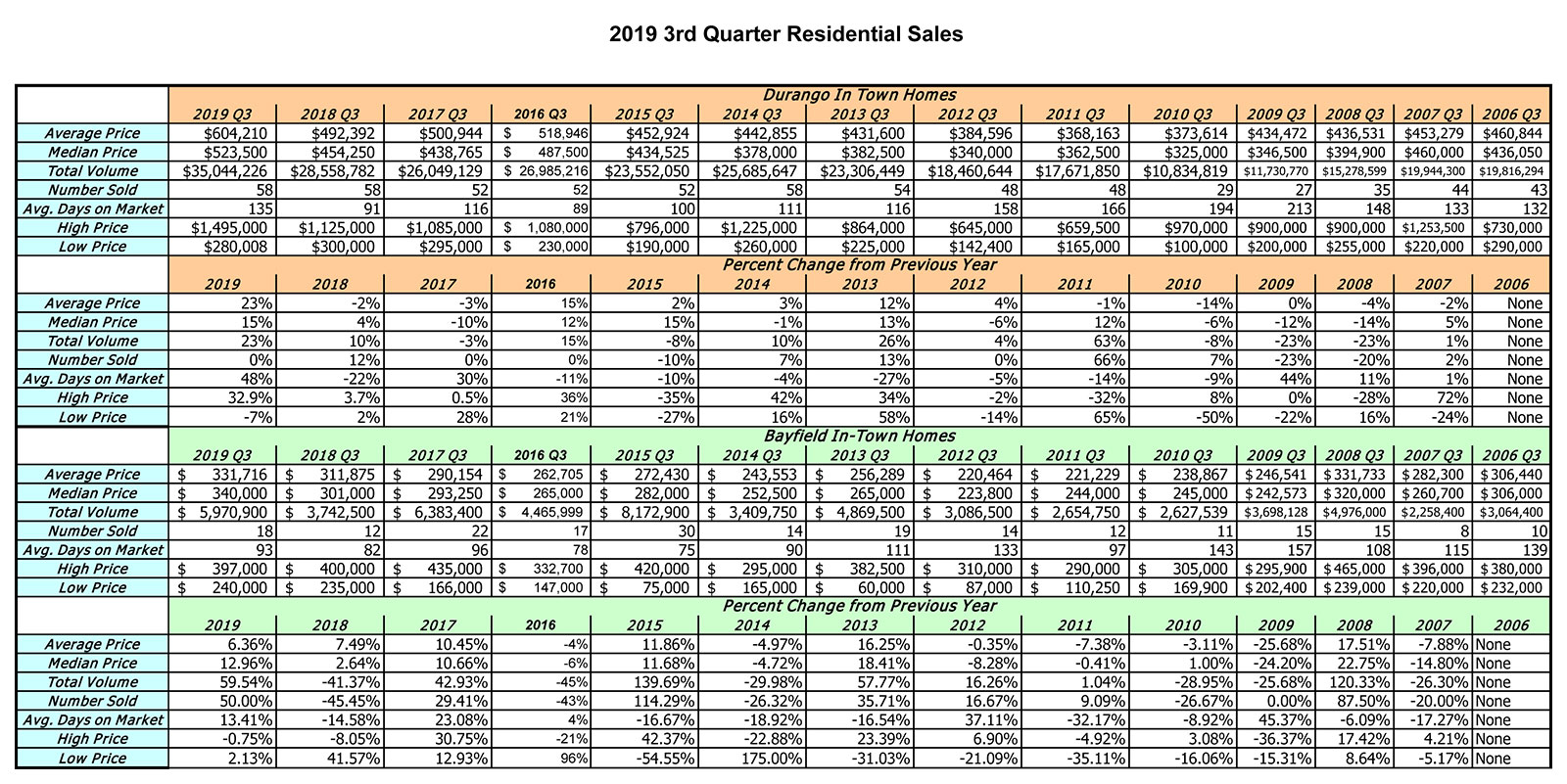

- The price of homes in the County stayed consistent with last year’s median price, hovering around $385,000, while the number of homes sold increased by more than 2%. The number of homes sold increased by 20 homes which was only a 2.4% increase. That figure of number-of-units-sold continues the trend that began about 3 years ago of reasonable flat sales. We are not getting huge spikes up or huge collapses downward either. It is overall a balanced market in the residential segment.

- All other segments of our market in this report saw nominal to modest increases in median price with fluctuations in the total number of properties sold that were better or worse depending on market segment and location.

- Durango Mountain Area Homes and Vacant Land (1-10 acres) are both down considerably through the end of the third quarter. We are seeing prices softening in some segments.

- Traditionally, Fall is the time for sales of luxury and high-end properties, and this year should not be any different.

Overall, we have a healthy local market; however, the increasing inventory of properties this fall may change the trend next year.

Many clients have been asking me about the future of the real estate market, and overall economy. I read an interesting article that I would like to share with you. It may answer the question we all asking these days: “When is the recession coming?”. You can read the entire article at…., however, here are a few key points:

Recession Jitters:

- The U.S. economy has been growing for 121 consecutive months, the longest run in the nation’s history.

- Between the first quarter of 2010 and the first quarter of 2019, the average equity per borrower increased to approximately $171,000 from about $75,000. WOW!

- We are experiencing the longest stretch of mortgage rates below 5% in more than 60 years. These economic forces have driven a recovery in home sales, construction, prices and home equity wealth.

- While home prices are still growing, they are doing so at a slower pace. Forecast expects a moderate 5.6% acceleration in annual home price growth from June 2019 to June 2020.

- The forecasts that come out do show a heightened risk. They show a slowdown in economic growth and a heightened probability of a recession in the future. So, the probability of a recession starting in 2020 is greater than in 2019. The risk of a recession starting in 2021 is greater than the risk of a recession starting in 2020. So, there’s this uncertainty that the slowdown in economic growth ultimately leads to a recession. We don’t know when, but that recession risk increases over time.

All real estate is local, and in small markets like ours, can vary greatly, based on home type and location. I highly encourage you to reach out to me, Gabi Bergstrom at RE/MAX Pinnacle for a more detailed analysis of specific areas or market segments that interest you. Thank you for choosing me as your Realtor!